Categories: Blockchain

The Power of DeFi Transactions: Building a Portfolio for the Future

DeFi transactions are transforming the financial landscape by enabling decentralized, peer-to-peer exchanges without intermediaries. These transactions offer greater transparency, lower fees, and increased accessibility, revolutionizing traditional finance with blockchain technology.

DeFi transactions are revolutionizing the way we invest. This article will explore the potential of DeFi and guide you in building a robust investment portfolio for the future.

Table of Contents

Defi Transactions

What is Decentralized Finance (DeFi) ?

Decentralized Finance (DeFi) is a new financial technology based on secure distributed ledgers, similar to ledgers used in cryptocurrencies. In the United States, the Federal Reserve and the Securities and Exchange Commission (SEC) establish rules for centralized financial institutions such as banks and brokerage firms, which consumers rely on to access capital and financial services directly. DeFi challenges this centralized financial system by empowering individuals through peer-to-peer transactions.

What is the Transaction?

A transaction is a completed agreement between a buyer and a seller to exchange goods, services, or financial assets for money. This term is also commonly used in corporate accounting. In business accounting, this simple definition can become complex. A transaction may be recorded by a company sooner or later depending on whether they use accrual accounting or cash accounting methods.

.jpg)

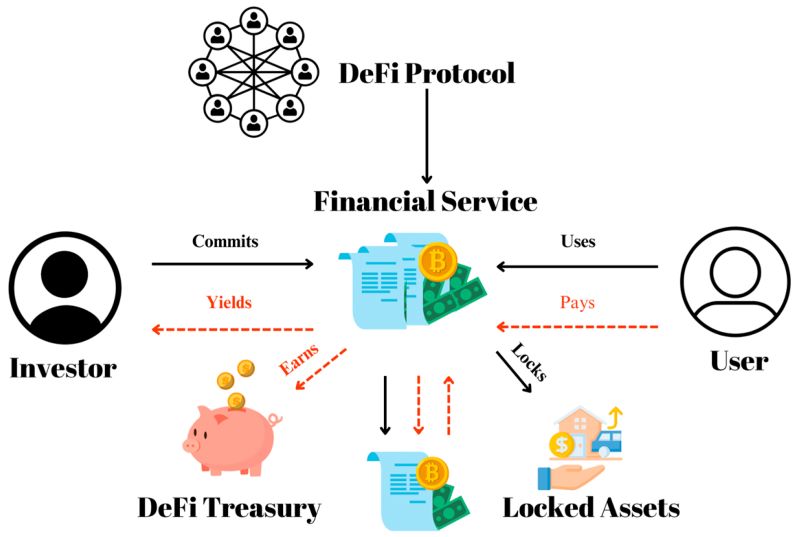

What are DeFi Transactions?

DeFi transactions, also known as decentralized finance transactions, are financial transactions that occur on blockchain networks without the need for traditional intermediaries like banks or financial institutions. These transactions are executed through smart contracts, which are self-executing agreements encoded on the blockchain.

Some key features of DeFi transactions include:

- Peer-to-Peer: DeFi transactions take place directly between users, eliminating the need for intermediaries.

- Transparency: All transactions are recorded on the blockchain, making them transparent and auditable by anyone.

- Immutable: Once a transaction is recorded on the blockchain, it cannot be altered or reversed, ensuring security and trust.

- Accessibility: DeFi transactions are accessible to anyone with an internet connection and a cryptocurrency wallet.

- Automation: Smart contracts automate various financial processes, making DeFi transactions efficient and cost-effective.

Foundational blockchains for DeFi

Ethereum

What is Ethereum?

Ethereum is a globally decentralized software platform supported by blockchain technology. It is best known among investors for its native cryptocurrency, Ether (ETH), and among developers for its use in developing blockchain applications and decentralized finance (DeFi).

How Does Ethereum Enable DeFi Transactions?

Ethereum's smart contract functionality allows for the automation of financial processes, making it an ideal platform for developing DeFi applications. These smart contracts can hold and manage funds, execute transactions, and interact with other dApps, making them a powerful tool for facilitating DeFi transactions.

Furthermore, Ethereum's scalability has been improved through upgrades such as Istanbul and Berlin, making it even more suitable for processing large volumes of transactions. This has led to the emergence of various DeFi protocols, including decentralized exchanges, lending platforms, and prediction markets, among others.

Top DeFi Protocols Built on Ethereum

- Uniswap - A decentralized exchange (DEX) that uses an automated market maker (AMM) model to facilitate trading between various ERC-20 tokens.

- Compound - A lending protocol that allows users to earn interest on their crypto holdings by supplying them to the protocol.

- MakerDAO - A protocol that allows users to mint stablecoin DAI by collateralizing their Ether.

- Aave - A decentralized lending and borrowing platform that supports a wide range of assets, including stablecoins and wrapped Bitcoin (WBTC).

- Synthetix - A derivatives trading platform that enables users to gain exposure to various real-world and crypto assets through synthetic versions of these assets.

Binance Smart Chain

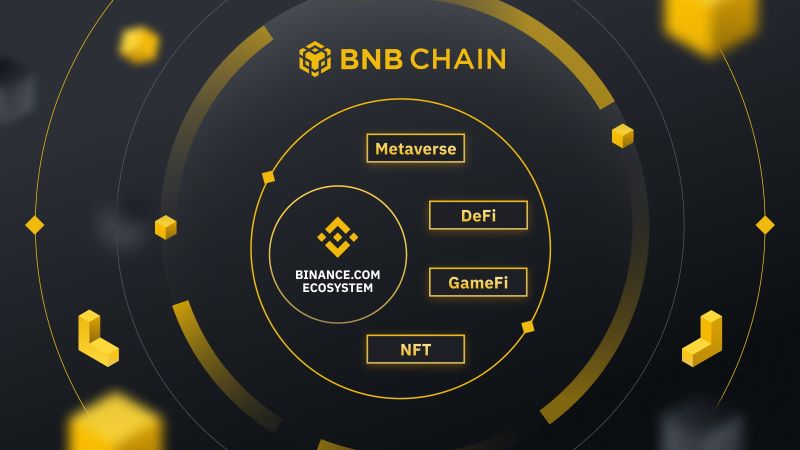

What is Binance Smart Chain?

aunched by the cryptocurrency exchange Binance, BNB Smart Chain (BSC), formerly known as Binance Smart Chain, is a blockchain network. It supports smart contracts and decentralized applications (DApps). BSC operates alongside BNB Chain, previously known as Binance Chain. The former supports smart contracts while the latter facilitates high transaction volumes with a block time of 3 seconds. Together, these blockchains form the Binance Chain.

How Does Binance Smart Chain Enable DeFi Transactions?

Similar to Ethereum, Binance Smart Chain also supports smart contracts, making it a suitable platform for developing DeFi applications. Moreover, BSC has lower transaction fees compared to Ethereum, making it more accessible to users with smaller amounts of capital.

Additionally, Binance has integrated its centralized exchange services with BSC, making it easier for users to access DeFi products directly from their exchange accounts. This has led to the growth of various DeFi protocols on BSC, with many mirroring existing protocols on Ethereum.

Top DeFi Protocols Built on Binance Smart Chain

- PancakeSwap - A popular decentralized exchange that uses an AMM model to facilitate trading between various BEP-20 tokens.

- Venus - A decentralized lending platform that supports various assets, including stablecoins and popular cryptocurrencies like Bitcoin and Ethereum.

- Autofarm - A yield aggregator that automatically farms the most profitable yield opportunities across different DeFi protocols on BSC.

- BurgerSwap - An automated market maker-based DEX that allows users to trade BEP-20 tokens and earn liquidity rewards.

- Cream Finance - A lending and borrowing platform that supports a wide range of assets and offers flash loans, which are loans that do not require collateral.

Polkadot

What is Polkadot?

Polkadot is a multi-chain protocol that enables cross-chain communication between different blockchains. It aims to solve the issue of interoperability, where different blockchains cannot communicate with each other, hindering the growth and adoption of the DeFi ecosystem.

Polkadot's architecture allows for the creation of specialized blockchains, known as parachains, that can be customized for specific use cases. These parachains can interact with each other and also connect to external networks, making it possible to transfer assets and data seamlessly.

How Does Polkadot Enable DeFi Transactions?

By connecting different blockchains through its relay chain, Polkadot makes it possible for DeFi protocols to access a wider pool of assets. This opens up new opportunities for developers and users and allows for more diverse and complex financial applications to be built.

Moreover, Polkadot's design allows for faster transaction processing and lower fees compared to Ethereum, making it an attractive option for DeFi transactions. It also offers advanced features such as governance and on-chain upgrades, providing a more efficient and sustainable ecosystem.

Top DeFi Protocols Built on Polkadot

- Acala - A DeFi hub that enables users to access various DeFi applications such as lending, staking, and stablecoins.

- Moonbeam - A smart contract platform that aims to make it easier for developers to migrate their dApps from Ethereum to Polkadot.

- Equilibrium - A decentralized borrowing and lending platform built on Polkadot that offers unique features like collateralized debt positions (CDPs).

- ChainX - A decentralized exchange that supports trading between different assets on Polkadot and other blockchain networks.

- Reef Finance - A multi-chain platform that allows users to access different DeFi protocols and trade various assets using a single interface.

Building a DeFi Portfolio for the Future

As the DeFi space continues to grow, it is essential to have a diversified portfolio to take advantage of the various opportunities available. With that in mind, here are some tips for building a DeFi portfolio for the future:

- Research different blockchains and understand their capabilities and potential for growth.

- Identify promising DeFi protocols on these blockchains and assess their risks and rewards.

- Diversify your investments across different protocols to mitigate risk.

- Keep track of your investments and regularly rebalance your portfolio to maximize returns.

- Stay informed about the latest developments and trends in the DeFi space to make informed investment decisions.

DeFi transactions are not merely transactions but a gateway to the promising future of decentralized finance. To fully harness this power, wise investors need to understand DeFi and choose reputable trading platforms that offer robust tools and a strong user community. With the continuous development of blockchain technology and groundbreaking projects like U2U Network, more attractive investment opportunities are on the horizon, allowing you to diversify your DeFi portfolio. Be ready to seize these opportunities and build a solid financial future with DeFi today.

.png)