This update is not just an enhancement; it's a complete overhaul of our platform's capabilities, meticulously crafted to meet the evolving needs of our diverse and dynamic user base. With these modifications, we are confident that U2W will bring about a new paradigm of decentralized trading, facilitating the most efficient and flexible AMM on the market.

In this article, we'll delve into the specifics of all the groundbreaking features in this update.

Concentrated Liquidity

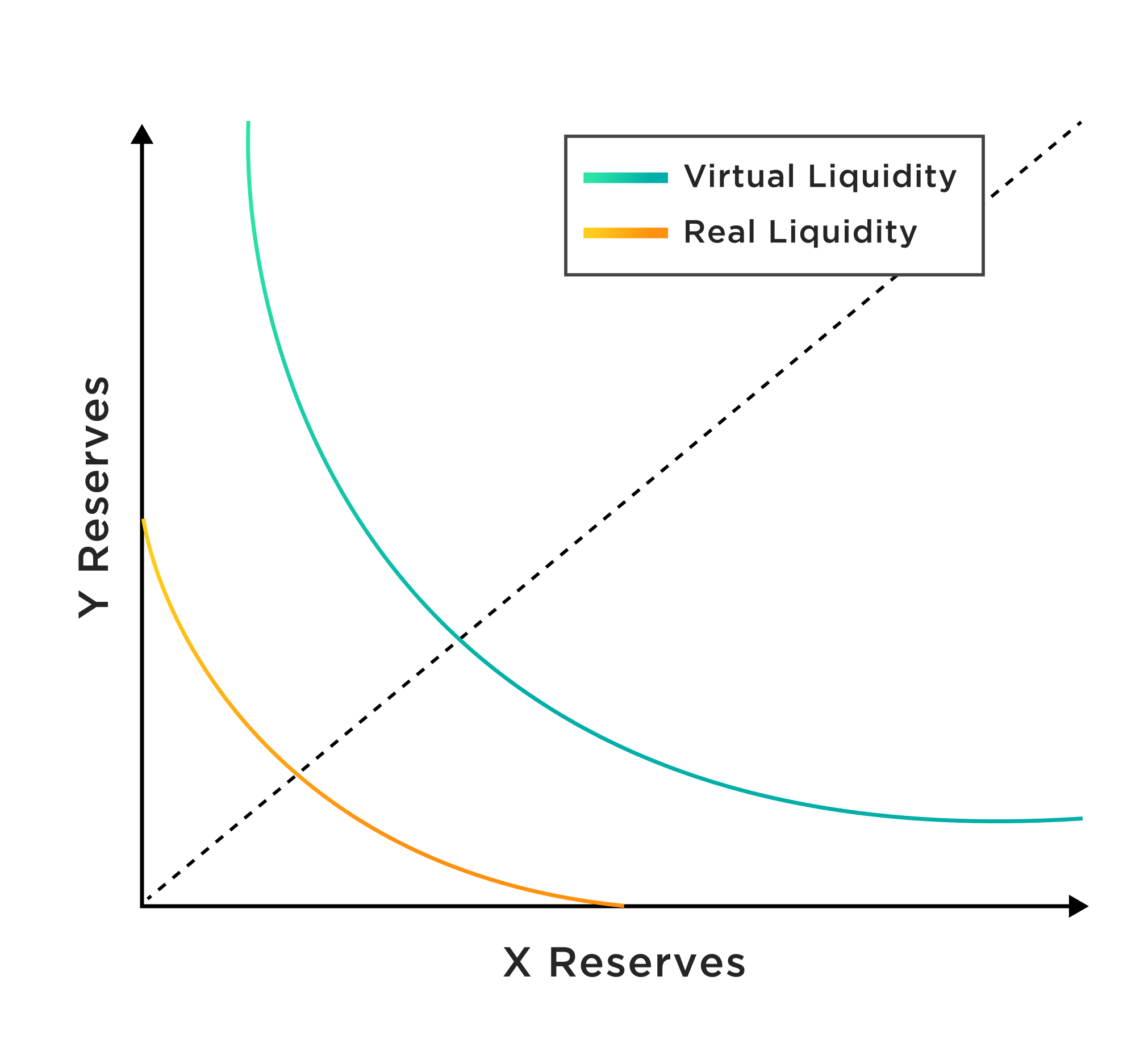

Traditionally, liquidity providers (LPs) would distribute their assets across a wide range of prices, often leading to inefficient use of capital because while this ensures liquidity is available for a broad array of potential trades, it also means that a significant portion of the LP's capital might be sitting idle at any given time, especially if most trading occurs within a narrower price range. This leads to inefficiency, as the LP's capital is not being fully utilized to earn fees or facilitate trades where they are most likely to occur.

In contrast, Concentrated Liquidity by U2W allows LPs to specify the exact price ranges where they want to allocate their capital. This focused approach means that LPs can provide liquidity more effectively where they anticipate the most trading activity, leading to potentially higher returns on their capital.

Here's how it works:

Targeted Price Ranges: LPs can select specific price brackets for their liquidity. For instance, if an LP expects a particular asset to trade mostly between $10 and $15, they can choose to allocate their liquidity solely within this range.

Increased Capital Efficiency: By focusing liquidity in certain price ranges, LPs can achieve higher capital efficiency. This means that with the same amount of capital, an LP can provide greater liquidity depth within their chosen range compared to the traditional method of spreading it thinly across a wider (essentially infinite) spectrum.

Dynamic Strategy: LPs can adjust their price ranges in response to market movements, allowing them to adapt their strategies in real-time. This flexibility is particularly valuable in volatile markets.

Enhanced Earnings: Concentrated Liquidity positions are more likely to be utilized, increasing the likelihood of earning fees. The more trades occur within an LP's selected range, the more fees they accumulate.

This innovative approach to liquidity provision not only maximizes the effectiveness of capital used by LPs but also contributes to the overall performance and efficiency of trading on U2W. By allowing LPs to concentrate their resources where they are most needed, we ensure a more robust and liquid trading environment for all our users.

Range Orders

As a feature made possible by Concentrated Liquidity, Range Orders allow Liquidity Providers (LPs) to place orders within a specific price range. This feature functions similarly to traditional limit orders but with added advantages inherent to decentralized finance.

With Range Orders, LPs can specify a range within which they want to buy or sell an asset. For example, an LP can set a range order to sell a token if its price falls between $10 and $12. When the market price enters the specified range, the order automatically executes. If the price of the token hits anywhere within the $10 to $12 bracket, the LP’s sell order is triggered.

In a sell range order, as the asset’s price enters and moves through the range, the specified asset is gradually sold off. For instance, if an LP sets a sell range order for a token in the $10 to $12 range, as the price increases within this bracket, the token is incrementally sold. If the market price moves out of the range, the remaining assets stay put unless the LP adjusts the range or the market price moves back into the range.

Besides the potential profit from the asset's price movement, LPs also earn fees from swaps that occur as the price moves through their specified range. This special benefit adds an additional incentive compared to traditional limit orders.

Range Orders thus provide LPs with a strategic tool to target specific price points for trading, while also benefiting from swap fees, offering a more active and potentially more profitable approach to liquidity provision. Within wider ranges, Range Orders are particularly useful for profit-taking, buying the dip, and primary issuance events.

Non-Fungible Liquidity

In this update, following the emergence of Non-Fungible Tokens (NFT), liquidity positions on U2W are no longer represented by fungible tokens. Instead, we introduce Non-Fungible Liquidity that will now represent LP positions as NFTs.

We expect this change to open the way for developing various sophisticated strategies including multi-positions, auto-rebalancing to concentrate around the market price, fee reinvestment, lending, and more.

Conclusion

The latest technical update to U2W represents a monumental leap forward in decentralized finance, specifically the decentralized trading landscape. By introducing various features such as Concentrated Liquidity, Range Orders, and Non-Fungible Liquidity, U2W not only addresses the inefficiencies of traditional AMM models but also sets a new standard for flexibility, profitability, and efficiency in the Decentralized Exchange space.

These features collectively empower our users with advanced tools and strategies, ensuring that U2W remains at the forefront of innovation in decentralized trading. We are excited to see how these enhancements will shape the future of trading on U2W and continue to drive our mission of revolutionizing decentralized finance.

.png)