Categories: Blockchain

Transforming Financial Systems: The Power of Blockchain in Finance

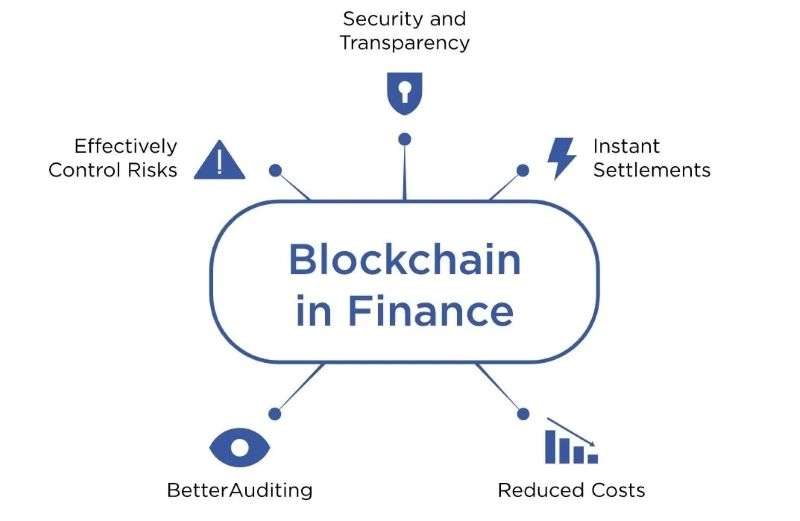

Blockchain in finance revolutionizes the industry by providing enhanced security, transparency, and efficiency. It facilitates faster cross-border transactions, reduces fraud, and enables decentralized finance (DeFi) platforms, offering innovative financial services and improving access to capital.

The global finance industry is on the brink of a technological revolution called blockchain. Beyond just creating Bitcoin, this distributed ledger technology is gradually reshaping how we transact, manage assets, and interact with financial systems. With its superior security, absolute transparency, and unparalleled efficiency, blockchain promises to address lingering issues in traditional finance, ushering in a new era of comprehensive and accessible financial services. Blockchain in finance is not merely a trend but the future of the financial industry.

Table of Contents

Introduction

The financial industry is essential for global economic stability but faces challenges like security breaches, high transaction costs, inefficiencies, and limited access to financial services. Blockchain in Finance offers a promising solution to these issues. This decentralized digital ledger technology ensures secure, transparent, and efficient transactions, addressing the industry's critical pain points. By revolutionizing how transactions are conducted and data is managed, blockchain can make financial systems more resilient and inclusive. Thesis statement: Blockchain technology has the power to transform financial systems by providing a secure, transparent, and efficient platform for transactions.

The Power of Blockchain in Finance

Improved Security and Transparency

Security: Blockchain uses cryptographic techniques to secure data, making it highly resistant to hacking and fraud. Each block in the chain is linked to the previous one through cryptographic hashes, creating a tamper-evident ledger.

Transparency: Transactions on a blockchain are visible to all participants in the network. This transparency reduces the chances of fraud and errors as every transaction is recorded and can be audited by any participant.

Example: Decentralized Data Storage for Secure Identity Verification - Financial institutions can use blockchain to store customer identity data securely. Instead of a centralized database vulnerable to breaches, blockchain ensures that identity data is encrypted and distributed across the network. This decentralization makes it significantly harder for malicious actors to compromise the system.

Reduced Costs and Increased Efficiency

Cost Reduction: By eliminating the need for intermediaries and automating processes, blockchain can significantly reduce transaction costs. Traditional financial systems involve multiple intermediaries, each adding to the cost and complexity of transactions.

Efficiency: Blockchain allows for near-instantaneous transactions, eliminating delays associated with traditional banking processes. Smart contracts, which are self-executing contracts with the terms directly written into code, automate the execution of agreements when predefined conditions are met.

Example: Smart Contracts for Automated Fraud Prevention - Smart contracts can automatically enforce terms and conditions, reducing the risk of fraud. For instance, in insurance claims, smart contracts can verify the occurrence of an insured event and automatically trigger payments without human intervention, reducing processing time and costs.

Enhanced Customer Experience

Speed: Blockchain enables real-time processing of transactions, which enhances the customer experience by reducing waiting times for transaction confirmations and fund transfers.

Reliability: With blockchain's decentralized nature, customers can trust that the system will be consistently available and reliable, even if some nodes in the network fail.

Example: Real-Time Fraud Detection Algorithms - Financial institutions can integrate real-time fraud detection algorithms with blockchain to continuously monitor transactions. Any suspicious activity can be flagged immediately, providing enhanced security and peace of mind to customers.

Increased Accessibility and Inclusivity

Financial Inclusion: Blockchain can provide financial services to unbanked and underbanked populations by reducing the dependency on traditional banking infrastructure. People in remote or underserved regions can access financial services via mobile devices and the internet.

Lower Barriers to Entry: Blockchain reduces barriers to entry for smaller players by lowering costs and providing a level playing field. This inclusivity fosters innovation and competition in the financial sector.

Example: Decentralized Finance (DeFi) Platforms - DeFi platforms leverage blockchain to offer financial services like lending, borrowing, and trading without intermediaries. These platforms provide access to financial services for individuals who may not have access to traditional banking systems, promoting financial inclusivity.

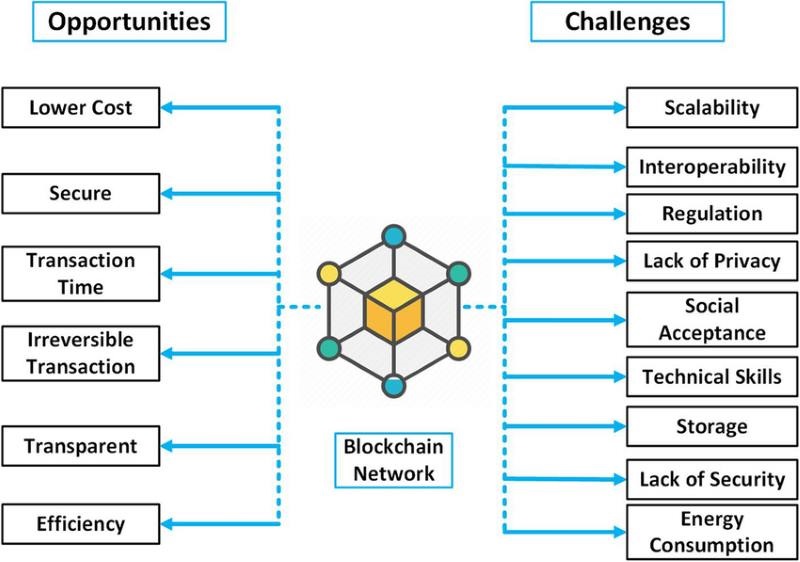

Challenges and Opportunities

Challenges Facing the Financial Industry

Regulatory Compliance: Financial institutions must navigate a complex web of regulations that vary by region and jurisdiction. Ensuring compliance with these regulations is costly and time-consuming, often requiring extensive documentation and reporting. Failure to comply can result in severe penalties and damage to reputation.

Cybersecurity Threats: The financial industry is a prime target for cyberattacks due to the sensitive nature of financial data. Cybersecurity threats, such as hacking, data breaches, and fraud, pose significant risks to financial institutions and their customers. Protecting against these threats requires substantial investment in security measures.

Limited Accessibility and Inclusivity: Despite advances in financial technology, a significant portion of the global population remains unbanked or underbanked. Barriers such as geographic location, lack of infrastructure, and socioeconomic factors limit access to financial services, preventing many individuals from participating fully in the economy.

Opportunities Presented by Blockchain Technology

Improved Regulatory Compliance: Blockchain can streamline regulatory compliance through its immutable and transparent ledger. Smart contracts can automate compliance processes by embedding regulatory requirements directly into transaction protocols. This reduces the burden of manual compliance checks and ensures real-time adherence to regulations.

Enhanced Cybersecurity: Blockchain's decentralized nature and cryptographic security features provide robust protection against cyber threats. Each transaction is encrypted and linked to the previous one, making it extremely difficult for hackers to alter information without detection. This enhances the security of financial data and reduces the risk of cyberattacks.

Increased Accessibility and Inclusivity: Blockchain technology can democratize access to financial services by lowering costs and removing intermediaries. Decentralized finance (DeFi) platforms enable individuals to access banking, lending, and investment services directly via the internet, regardless of their geographic location or socioeconomic status. This increased accessibility promotes financial inclusion and empowers underserved populations.

Blockchain is revolutionizing the financial industry, bringing unprecedented improvements in efficiency, transparency, and accessibility. As a leading decentralized social platform, U2U Network exemplifies the significant potential of blockchain in empowering individuals and communities. While U2U does not directly process financial transactions, the platform leverages blockchain's fundamental principles to enhance trust, transparency, and data ownership among its users, aligning with the broader goals of decentralized finance.

The integration of blockchain in finance is reshaping traditional systems, unlocking new opportunities for financial inclusion, cross-border payments, and decentralized finance (DeFi). U2U Network, committed to community building and user empowerment, plays a crucial role in raising awareness and promoting the adoption of these advanced technologies. By providing a platform for open dialogue and collaboration, U2U bridges the gap between the complexities of blockchain and the practical needs of everyday users, contributing to the development of a fairer and more accessible financial system.

.png)