Categories: Blockchain

Is Avalanche's Low Latency Blockchain Suitable for High-Frequency Trading?

Explore "Avalanche's Low Latency Blockchain" a cutting-edge technology offering unparalleled transaction speed and efficiency. Avalanche's innovative approach ensures rapid, secure, and scalable solutions, making it a leader in the blockchain space and driving advancements across various industries.

In the fast-paced world of high-frequency trading (HFT), where split-second decisions can make or break fortunes, speed is not just a competitive advantage but a fundamental requirement. Traditional financial systems often struggle to keep up with the demands of HFT, plagued by latency issues and scalability constraints. Enter Avalanche's low latency blockchain, a high-performance platform renowned for its impressive throughput capabilities. In this article, we delve into how Avalanche's cutting-edge technology addresses these challenges, offering traders unprecedented speed and efficiency in executing transactions.

Table of Contents

The Need for Speed in High-Frequency Trading

In the fast-paced realm of high-frequency trading (HFT), speed reigns supreme. Here, sophisticated algorithms crunch market data and execute trades in mere microseconds or nanoseconds, exploiting fleeting market discrepancies and arbitrage opportunities. This strategy thrives on swift transactions, offering traders enhanced profitability, minimized risk through short-term positions, and improved market liquidity.

Yet, traditional financial infrastructures, rooted in outdated technology, struggle to match the velocity demanded by HFT. Latency issues, delays in data transmission and order execution, frequently lead to missed profit opportunities. Scalability concerns further hinder these systems, unable to efficiently manage the colossal transaction volumes HFT generates, causing congestion and additional delays. Moreover, the hefty costs associated with traditional financial transactions—exchange fees, clearing charges—further eat into HFT profits.

This clash between HFT's need for speed and the limitations of conventional systems underscores a critical need for innovation in financial infrastructure. Blockchain technology emerges as a promising solution, offering near-instantaneous transaction speeds and reduced costs. Avalanche, with its low latency blockchain platform, stands out in this arena. Featuring a unique consensus mechanism and subnet architecture, Avalanche supports high throughput and rapid transaction finality, making it an attractive choice for high-frequency traders aiming to gain a competitive edge.

How does Avalanche consensus work?

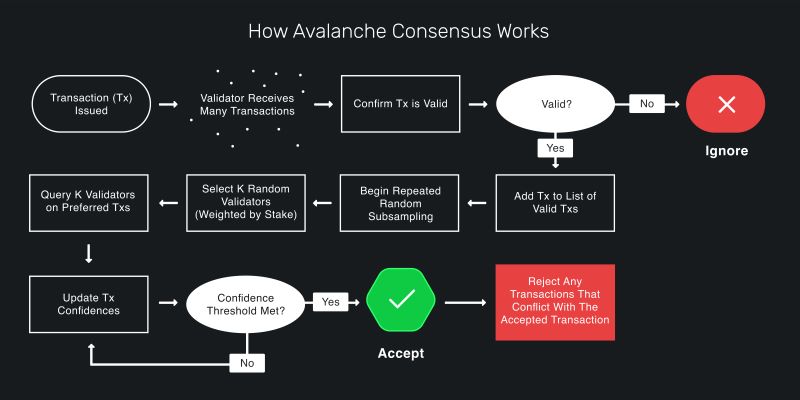

Transactions begin by being issued and propagated throughout the network. Validators, responsible for maintaining the blockchain, receive these transactions and independently assess their validity. If a transaction is found to be invalid, it is promptly rejected. Valid transactions proceed to the next stage without immediate acceptance.

Validators then engage in a process where each queries a randomly selected subset of other validators about their preferred transactions. This subset selection is weighted by each validator's stake in the network. Subsequently, a random group of validators is chosen based on their stakes, with higher stakes increasing the likelihood of selection.

The chosen validators initiate a repeated process of querying each other on their transaction preferences. If a transaction garners sufficient support from this sampled subset, it is added to the validator's list of valid transactions. Throughout this process, validators continuously update their confidence levels for each transaction based on feedback from the sampled validators.

Transactions continue this iterative process until a predefined confidence threshold is met. Once reached, the transaction is deemed accepted and added to the blockchain. Any transactions conflicting with the accepted one are promptly rejected to maintain consensus integrity.

This iterative and probabilistic approach ensures that Avalanche can achieve rapid transaction finality and high throughput while maintaining decentralization and security across its network.

Avalanche's Low Latency Blockchain

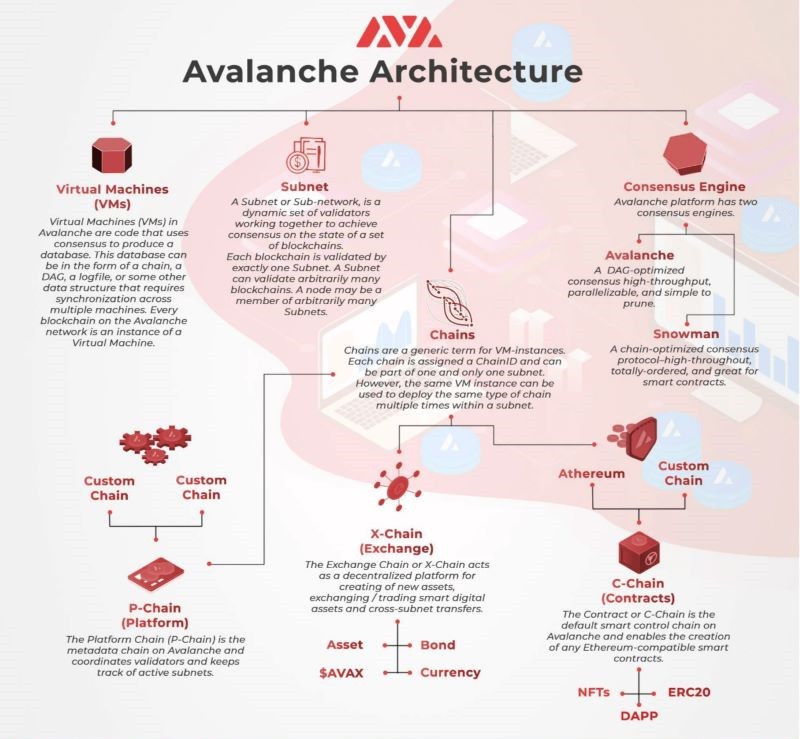

Avalanche stands at the forefront of blockchain innovation with its low latency blockchain, revolutionizing transaction speed and efficiency. To grasp the intricacies behind its exceptional performance, we delve into its unique architecture and foundational technologies.

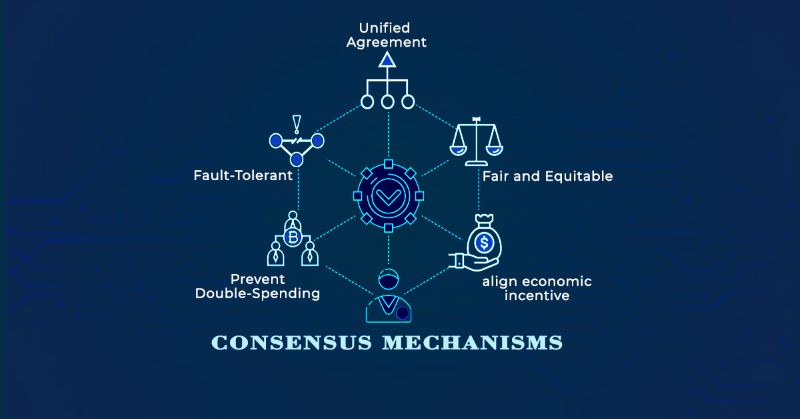

Consensus Mechanism

Avalanche's pioneering consensus protocol, aptly named Avalanche consensus, breaks away from traditional models like PoW and PoS. Instead, it employs "repeated subsampled voting," where a random subset of nodes repeatedly samples the network to validate transactions swiftly and efficiently.

Subnet Architecture

Central to Avalanche's architecture is its subnet design—autonomous blockchains within the Avalanche ecosystem. Each subnet operates independently with its validators and consensus rules, allowing simultaneous transaction processing across multiple subnets.

This architecture enhances efficiency by:

- Reducing Latency: Parallel processing across subnets minimizes transaction delays, optimizing overall network performance.

- Customizability: Subnets can be tailored to meet diverse application needs, ensuring optimal performance across various use cases from financial transactions to decentralized applications.

Transaction Speed and Finality

Avalanche sets benchmarks in transaction speed and finality. While performance metrics may vary based on network conditions and transaction complexities, Avalanche consistently achieves high transaction throughput with near-instant finality.

In contrast, Bitcoin manages about 7 transactions per second with PoW, and Ethereum anticipates up to 100 TPS with PoS. Avalanche's superior capabilities position it as the ideal platform for high-frequency trading and other time-sensitive applications, redefining possibilities in blockchain technology.

Benefits of Avalanche's Low Latency Blockchain for High-Frequency Trading

In the fast-paced realm of high-frequency trading (HFT), where microseconds can make or break profits, Avalanche's low latency blockchain emerges as a game-changer. Tailored to meet the exacting demands of HFT, Avalanche offers a suite of advantages that redefine trading efficiency.

Reduced Latency

In HFT, every millisecond counts. Avalanche's low latency blockchain significantly minimizes the time required for trade execution and confirmation. This near-instantaneous transaction processing empowers HFT traders to swiftly capitalize on market movements, seizing fleeting opportunities and outpacing competitors.

Increased Throughput

HFT involves executing a vast number of transactions within fractions of a second. Traditional financial systems often struggle to keep up with this demand.

Avalanche's innovative consensus mechanism and subnet architecture ensure high throughput, enabling seamless processing of thousands of transactions per second. This capability not only supports the rapid execution of trades but also maintains efficiency during periods of peak market activity, enhancing overall trading performance.

Lower Transaction Costs

Transaction costs pose a significant challenge to profitability in HFT. Conventional financial platforms levy substantial fees per transaction, eroding potential gains from high-frequency strategies.

By leveraging Avalanche's efficient transaction processing, HFT traders benefit from lower transaction costs. Reduced fees enhance profitability, particularly for strategies reliant on frequent, small-scale trades. This cost-effectiveness amplifies the financial advantages of HFT, allowing traders to optimize their strategies without being hampered by excessive transaction expenses.

Navigating Challenges in High-Frequency Trading with Avalanche

High-frequency trading (HFT) relies on Avalanche's low latency blockchain to optimize transaction speed and efficiency. However, leveraging this cutting-edge technology demands careful consideration of critical factors to ensure operational success.

Security

In the fast-paced realm of HFT, security is paramount. Avalanche employs robust measures like its unique Avalanche consensus, designed to resist attacks such as 51% assaults and double-spending. The subnet architecture further enhances security by isolating potential vulnerabilities within independent subnets. Continuous third-party audits ensure ongoing evaluation and improvement of these defenses. However, HFT practitioners must supplement these measures with rigorous security protocols to safeguard their assets and infrastructure effectively.

Regulatory Landscape

Operating HFT on a blockchain platform like Avalanche involves navigating a complex regulatory environment. Global regulations vary significantly, necessitating comprehensive compliance strategies. Adapting to regulatory changes is crucial for maintaining operational resilience and ensuring adherence to local laws. This requires traders to stay informed and collaborate closely with legal experts to mitigate legal risks and uphold compliance standards.

Adoption and Liquidity

Avalanche offers promising technological capabilities for HFT, but adoption challenges and liquidity dynamics pose practical considerations. The ecosystem supporting Avalanche's decentralized finance (DeFi) platforms for HFT is still in its early stages, potentially affecting liquidity and trade execution efficiency. Limited liquidity on Avalanche's decentralized exchanges (DEXs) may pose challenges in executing large trades, necessitating proactive risk management strategies to minimize potential slippage. As Avalanche's ecosystem matures and attracts more participants, liquidity is expected to improve, thereby enhancing overall trading efficiency and market accessibility.

In the relentless pursuit of speed and efficiency, Avalanche's low latency blockchain emerges as a beacon of hope for high-frequency traders. Its innovative consensus mechanism, subnet architecture, and impressive transaction speeds provide an attractive alternative to traditional financial systems, often plagued by latency, scalability issues, and high costs.

Avalanche's ability to reduce latency, increase throughput, and lower transaction costs creates significant opportunities for HFT traders to gain competitive advantages and maximize profits. However, it is crucial to acknowledge the challenges ahead, including concerns about security, regulatory uncertainties, and the need for further liquidity and adoption.

Looking forward, expanding the horizon for high-frequency trading involves exploring new alternatives such as U2U Network, a rising platform in the blockchain space developing a low latency blockchain with innovative features like sharding and novel consensus mechanisms. These advancements hold potential to address scalability challenges and provide even higher speeds and efficiencies for HFT strategies.

As the blockchain technology landscape continues to evolve, platforms like U2U Network are pushing the boundaries of what's possible. By staying updated on these developments, high-frequency traders can position themselves at the forefront of technological innovation, unlocking new opportunities for growth and profitability.

Whether it's Avalanche, U2U Network, or other emerging platforms, the future of high-frequency trading in the blockchain space is poised to be fascinating. As these technologies mature and gain broader adoption, we can expect significant transformations in how financial markets operate, with speed, efficiency, and decentralization taking center stage.

.png)