Table of Contents

- What is Ponzi?

- Who is the Originator of the Ponzi Scheme?

- What's the Origin of the Term Ponzi Scheme?

- Members of the Ponzi Scheme

- Characteristics of the Ponzi Scheme

- Operation Method of the Ponzi Scheme

- Indicators for Identifying a Ponzi Fraud

- Why Unicorn Ultra Ponzi Will Never Become a Reality?

- How to Steer Clear of Projects Involving Ponzi Schemes?

What is Ponzi?

A Ponzi scheme is a fraudulent scheme that entices investors by using money from new investors to pay returns to earlier investors. It is named after the Italian businessman Charles Ponzi. This scheme tricks victims into thinking that the profits are generated from genuine business operations, while they are unaware that the source of funds is actually other investors. A Ponzi scheme can sustain the appearance of a viable business as long as fresh investors inject new capital, and as long as the majority of investors do not insist on complete repayment and continue to have faith in the fictitious assets they are told they possess.

Who is the Originator of the Ponzi Scheme?

The infamous Charles Ponzi, an Italian immigrant to the United States, is credited with popularizing the Ponzi scheme. In the early 1920s, Ponzi promised investors a 50% return on their investments in just 45 days or a 100% return within 90 days. His investment vehicle, the Securities Exchange Company, attracted a flurry of investors hoping to cash in on these extraordinary returns.

What's the Origin of the Term Ponzi Scheme?

The term "Ponzi scheme" stems from Charles Ponzi's last name. As news of his fraudulent scheme spread, the public began referring to such scams as "Ponzi schemes" in his honor.

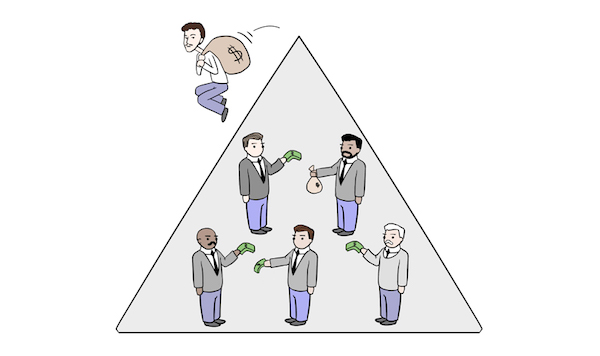

Members of the Ponzi Scheme

Ponzi schemes typically involve three key players:

- The Promoter: This individual or group initiates and operates the scheme, luring in investors with promises of high returns.

- Early Investors: Those who invest in the scheme during its initial stages and receive payouts, often believing the venture is legitimate.

- Late Investors: Individuals who invest later in the scheme, usually drawn by the success stories of early investors.

Characteristics of the Ponzi Scheme

Ponzi schemes share several common characteristics, including:

- The promise of high returns with little or no risk.

- Consistent payment of returns to earlier investors.

- Reliance on new investments to pay returns.

- Lack of a legitimate underlying business or investment activity.

- Secrecy and evasion of regulatory oversight.

Operation Method of the Ponzi Scheme

The operation of a Ponzi scheme typically follows these steps:

- The promoter establishes an investment vehicle and solicits funds from investors.

- Early investors are paid "returns" using the capital contributed by new investors.

- Word spreads about the scheme's high returns, attracting more investors.

- The operator uses a portion of incoming investments for personal gain while continuing to pay returns to earlier investors.

- Eventually, the scheme collapses when the operator cannot attract enough new investments to cover returns to earlier participants.

Indicators for Identifying a Ponzi Fraud

Detecting a Ponzi scheme can be challenging, but several indicators can help identify potential fraud:

- Promises of unusually high returns with minimal risk.

- Lack of transparency about the investment strategy or business model.

- Pressure to recruit new investors or focus on referral bonuses.

- Difficulty in withdrawing funds or receiving promised returns.

- Avoidance of regulatory oversight or registration.

Why Unicorn Ultra Ponzi Will Never Become a Reality?

In the blockchain industry, a harsh reality is the erosion of trust over time, leading new projects to face skepticism from the community, especially during their launch phase. Unicorn Ultra (U2U) is not immune to such skepticism, as rumors of a "Unicorn Ultra Ponzi" have started circulating.

Unicorn Ultra itself is a potential blockchain project that introduces a fresh approach to blockchain-based startup projects, harnessing the power of community support.

Unicorn Ultra employs a crowdfunding approach through public sale rounds, much like other blockchain projects. However, instead of an Initial DEX Offering (IDO), the Unicorn Ultra development team has chosen to implement Security Token Offerings (STOs) to raise funds. Unlike IDOs, STOs are legally recognized and operate within regulatory frameworks in the countries where they are conducted.

Crucially, the U2U Team unequivocally asserts that there are no interest payments to investors in a Ponzi-like fashion, where funds are taken from new investors to pay earlier ones. The funds raised through STO fundraising are allocated toward the expansion of the U2U Foundation, with grants awarded to projects developed within the U2U Chain and the broader Unicorn Ultra ecosystem.

Instead, investors stand to profit from the success of projects that receive funding through their investments, with profit-sharing ratios determined by each individual project.

Furthermore, investors can earn revenue by holding U2U tokens, which serve as the default gas fees within the ecosystem. According to the U2U Tokenomic allocation, U2U tokens will automatically vest for investors who participated in the STO within six months of the Mainnet launch.

As the number of projects developed on the U2U Chain grows, the demand for U2U tokens increases, subsequently boosting their value. To foster more projects within the U2U Chain, the project aims to scale the U2U Foundation, which is why Unicorn Ultra actively seeks investments from the community.

Therefore, for those who meticulously research Unicorn Ultra and its STO, the answer becomes clear: Unicorn Ultra (U2U) is not a Ponzi scheme, based on its fundraising principles and crowdfunding plans. The ultimate goal is to build a robust U2U Foundation, serving as a vital resource foundation for startups.

How to Steer Clear of Projects Involving Ponzi Schemes?

Protecting yourself from falling victim to a Ponzi scheme requires diligence and skepticism:

- Conduct Due Diligence: Research the investment opportunity thoroughly, including the background of the promoter and the legitimacy of the business.

- Verify Returns: Be wary of investments that promise unrealistic returns; if it sounds too good to be true, it probably is.

- Seek Regulatory Compliance: Ensure that the investment or project complies with relevant financial regulations and is registered with appropriate authorities.

- Avoid Pressure Tactics: Refrain from investing under pressure and steer clear of projects that heavily emphasize recruitment over product or service offerings.

- Diversify Investments: Diversification can help spread risk and protect your portfolio from potential scams.

Conclusion

Ponzi schemes continue to be a menace in the world of finance, preying on the trust and aspirations of unsuspecting investors. By understanding 'What is Ponzi' and recognizing warning signs, you can safeguard yourself from falling victim to these fraudulent schemes. Through this article, we also affirm that Unicorn Ultra Ponzi Will Never Become a Reality.