DeFi has always been a unique realm of the blockchain industry, where it helps to unleash the full potential of staking assets. The arrival of LSDFi is once again a reflection of how DeFi is innovating this industry; and in this blog, we'll delve into exploring what is LSDFi and what makes LSDFi so compelling.

Table of Contents

What is LSDFi?

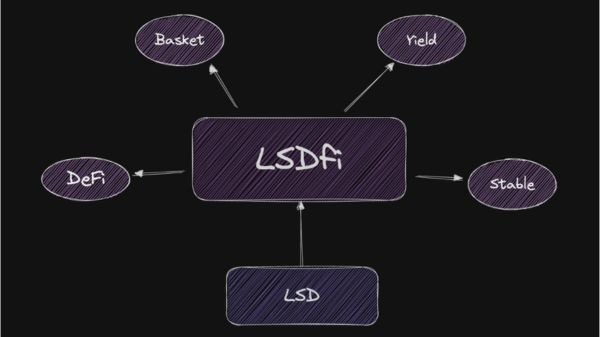

LSDFI represents a collection of protocols that harness the capabilities of the LSD (Liquid Staking Derivatives) platform and its associated tokens for conducting financial transactions within the DeFi sector. To grasp the concept of LSDFI, it's essential to familiarize oneself with LSD and LST (Liquid Staking Token). Within the LSD Platform, participants receive LST tokens commensurate with the value of their assets locked in liquid staking.

Presently, the LSD ecosystem boasts the DeFi industry's largest Total Value Locked (TVL), totaling $18.4 billion. Lido Finance commands approximately 78% of this LSD market share. The LSDFI protocols were conceived with the aim of catering to users engaged in liquid staking. Furthermore, the LSDFI ecosystem was established with the expectation that Ethereum staking rates, as seen in protocols like Lido, will continue to ascend over the long term.

In essence, the LSDFI Platform enables users to generate additional interest on top of the returns they receive from staking. This represents the primary user-facing function of LSDFI applications. LSDFI applications employ Liquid Staking Tokens (LSTs) like stETH, rETH, and frxETH in diverse DeFi activities, such as serving as collateral for loans and participating as liquidity providers. Each LSDFI platform continually innovates by introducing various use cases to attract users.

LSDFI Glossary:

- Liquid Staking Derivative (LSD): LSD is the term used to describe liquid staking applications.

- Liquid Staking Token (LST): Refers to the token associated with an LSD platform, such as stETH for Lido, rETH for Rocket Pool, and frxETH from Frax Finance.

- Liquid Staking Derivative Finance (LSDFI): LSDFI is the term used for protocols that leverage the LSD (Liquid Staking Derivatives) platform and its tokens for financial activities within the DeFi industry.

How does LSDFi work?

The operation of LSDFI platforms is, in essence, straightforward. To illustrate, LSDFI applications such as Lybra Finance make use of individuals who hold LST tokens, such as stETH, for diverse financial activities. In the case of Lybra, users can employ their stETH as collateral on the Lybra platform to generate eUSD, which is Lybra's decentralized stablecoin. Each LSDFI application serves its own unique purposes and provides users with distinct advantages.

Essentially, the functioning of LSDFI is not significantly different from the typical activities within the DeFi industry. If you have experience as a liquidity provider or have staked LP tokens, you'll recognize the source of your earnings within an LSDFI protocol. The key distinction lies in the ability to aggregate multiple sources of interest from various protocols.

Why is LSDFi so attractive?

There are two reasons.

Its potential

LSDFi is a vast realm encompassing various projects with various functionalities. These projects range from traditional decentralized exchanges (DEXs) and lending protocols to more intricate protocols that leverage distinct properties of Liquidity Staking Tokens (LST). The total value locked (TVL) in LSDFi stands impressively at over $396 million.

LSDfi has evolved into an autonomous domain within DeFi and continues to make notable progress. One significant element of LSDfi is the introduction of the LSD Basket concept. With multiple liquid staking solutions available for Ethereum (ETH), protocols have been devised to combine these solutions into a single basket, forming an index. This approach not only enables risk diversification but also enhances the convenience of investing in LSD.

Ethereum's Shanghai upgrade

The reason LSD has become so attractive in the current context is due to Ethereum's upcoming Shanghai upgrade, which allows unlocking the amount of ETH staked since 2020 for The Merge. At the same time, the Shanghai update also provides flexibility in stake/unstake without being locked as before.

Because the amount of ETH currently staking is only about 14% - a very modest number compared to other chains - the community believes that the Shanghai upgrade will increase the stake rate thanks to the open mind of the holders. This ETH is mainly from long-term whales; otherwise, it will be difficult for them to dump low prices. And since this ETH needs a place to be fully absorbed, LSD Lending and especially NFT are ideal destinations.

Conclusion

LSDFI comprises a series of protocols that leverage the Liquid Staking Derivatives (LSD) platform and its associated tokens for conducting financial operations within the realm of DeFi. Participants will accrue Liquid Staking Token (LST) tokens corresponding to the value of their assets held in staking.

We hope that through our article What is LSDFi, we can be of assistance to you. Follow U2U to update more crypto investment knowledge.