Blockchain, the revolutionary technology behind Bitcoin and various cryptocurrencies, holds immense potential to transform industries like finance and supply chains. However, before diving into its promising applications, it's crucial to address the question: what are the risks of blockchain technology? While blockchain offers numerous benefits, it's not without its drawbacks. Join us as we delve into the potential risks associated with blockchain, including security vulnerabilities, regulatory challenges, and complex legal issues. By understanding both sides of the coin, we can gain a more comprehensive and objective perspective on this trending technology.

Table of Contents

What is blockchain technology

Blockchain technology is an advanced database mechanism that allows transparent information sharing within a business network. A blockchain database stores data in blocks that are linked together in a chain. The data maintains chronological consistency because you cannot delete or modify the chain without consensus from the network. Therefore, you can use blockchain technology to create an immutable and unalterable ledger to track orders, payments, accounts, and other transactions. The system has built-in mechanisms to prevent unauthorized transaction entries and create consistency in the shared view of these transactions.

What are the risks of blockchain technology

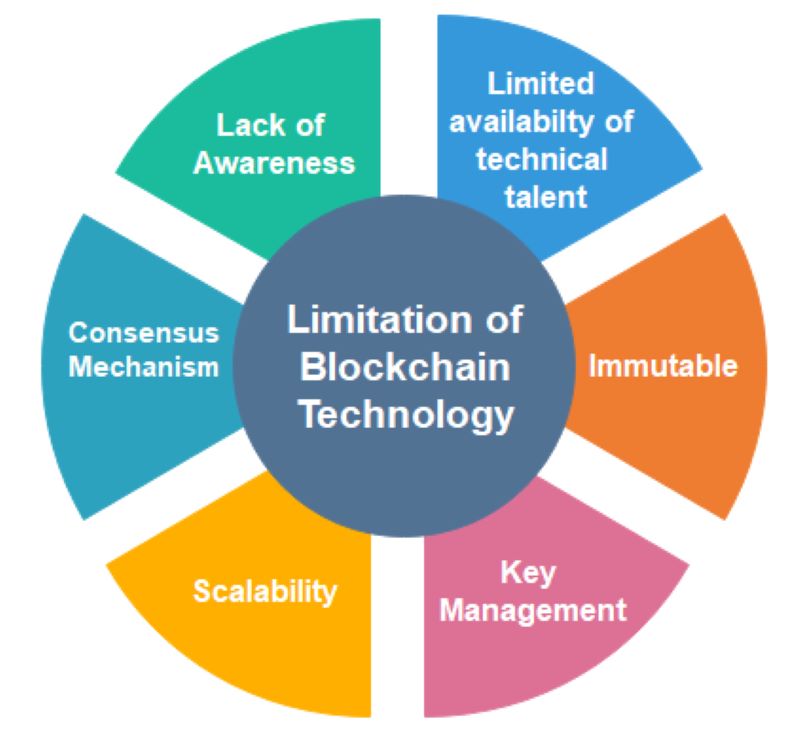

Blockchain technology, while secure in many aspects, faces several key security risks that users and developers must navigate to protect assets and maintain system integrity.

51% Attacks: A 51% attack occurs when a single entity or group controls more than half of a blockchain network's computing power. This control enables them to manipulate transactions, potentially double-spend coins, and disrupt the network. Although rare on larger blockchains due to their extensive computing power, smaller networks are vulnerable. Mitigating these attacks requires robust security protocols and encouraging diverse participation in network validation.

Smart Contract Vulnerabilities: Smart contracts are susceptible to coding errors and logical flaws that can be exploited by attackers. These vulnerabilities can lead to financial loss, data manipulation, or service disruptions. Rigorous auditing and testing of smart contracts before deployment are essential to identify and address potential weaknesses.

Private Key Management: Private keys are crucial for authorizing transactions on the blockchain. Losing or compromising a private key can result in irreversible loss of assets. Secure storage practices, such as using hardware wallets, encrypted backups, and multi-signature schemes, are essential to protect private keys from unauthorized access or loss.

Quantum Computing Threat: Quantum computers pose a theoretical threat to blockchain security by potentially breaking current cryptographic algorithms like elliptic curve cryptography (ECC). This could compromise the confidentiality and integrity of blockchain transactions. Research into quantum-resistant cryptography is ongoing to develop algorithms that can withstand future quantum computing capabilities and maintain blockchain security.

Blockchain technology, renowned for its decentralized and disruptive characteristics, presents unique challenges for regulatory bodies and legal frameworks globally.

The regulatory landscape surrounding blockchain remains in its infancy, with numerous jurisdictions lacking definitive guidelines and standards. This ambiguity creates uncertainty for businesses and individuals alike, hindering their ability to assess the legal implications of adopting blockchain technology and navigate compliance requirements effectively. The absence of regulatory clarity also poses a barrier to innovation, as businesses may hesitate to invest in blockchain solutions without a clear understanding of the legal landscape and potential liabilities.

Even in jurisdictions with existing regulations, compliance can be intricate for blockchain-based applications. Traditional financial regulations such as anti-money laundering (AML) and know-your-customer (KYC) requirements were primarily designed for centralized systems and may not seamlessly apply to decentralized blockchain networks. Balancing the inherent transparency and traceability of blockchain with the privacy and anonymity it affords can be particularly challenging when implementing regulatory requirements.

The use of blockchain in smart contracts introduces novel legal considerations. Smart contracts, which automatically execute agreements based on predefined conditions, rely on blockchain's immutability to maintain integrity. However, this immutability can complicate dispute resolution processes and rectifying errors within contracts. Moreover, the cross-border nature of blockchain transactions can lead to jurisdictional conflicts, as different countries may have conflicting laws and regulations regarding blockchain and digital assets.

The widespread adoption of blockchain technology has sparked concerns regarding its environmental impact, largely driven by the energy consumption associated with certain consensus mechanisms.

Proof-of-Work (PoW) blockchains, exemplified by Bitcoin, necessitate miners solving complex mathematical problems to validate transactions and secure the network. This process demands significant computational power, resulting in substantial energy consumption. Criticism of blockchain's environmental footprint has intensified, with studies indicating that Bitcoin alone consumes as much energy as some small countries.

Efforts within the blockchain community are actively focused on developing more sustainable solutions. Proof-of-Stake (PoS) represents a prominent alternative where validators secure the network by staking or locking up their cryptocurrency holdings, dramatically reducing energy requirements compared to PoW. Innovations such as Delegated Proof of Stake (DPoS) and Proof of Authority (PoA) also offer efficient consensus mechanisms.

What are the risks of blockchain technology U2U Network stands out as a leader in developing environmentally friendly blockchain solutions. Utilizing a Directed Acyclic Graph (DAG) architecture instead of a conventional blockchain, U2U Network significantly diminishes energy consumption for consensus and transaction validation. This approach not only enhances sustainability but also boosts scalability and transaction speed. U2U Network's commitment to energy efficiency underscores the industry's growing awareness of blockchain's environmental impact and ongoing efforts to cultivate eco-friendly solutions.

Other Risks Associated with Blockchain Technology

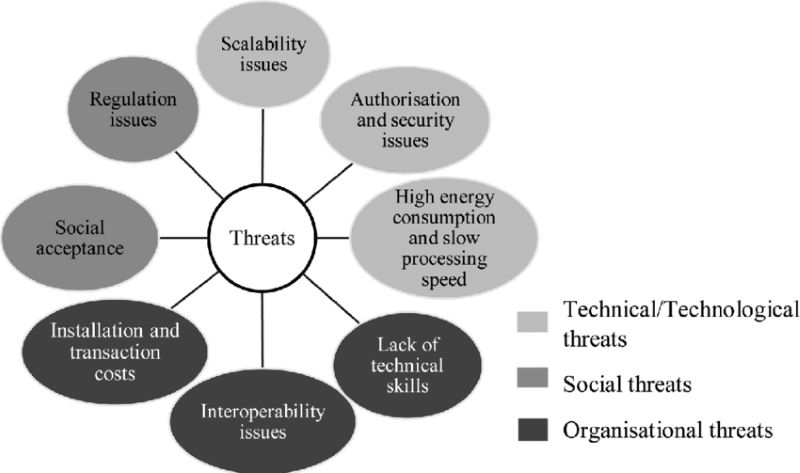

In addition to security and regulatory challenges, blockchain technology faces several inherent risks that could potentially impact its widespread adoption and utility:

Scalability Limitations

Transaction Bottlenecks: Many blockchain networks, especially older ones like Bitcoin, have limited transaction throughput. This can lead to network congestion and slow confirmation times during periods of high demand, resulting in increased transaction fees and hindering the adoption of blockchain for high-volume applications.

The Trilemma: Blockchain faces the challenge of achieving scalability, security, and decentralization simultaneously. Improving one aspect often comes at the expense of the others. For instance, increasing block size to handle more transactions might compromise decentralization, impacting network security and resilience.

Irreversibility

Double-Edged Sword: Blockchain's immutability ensures data integrity and prevents tampering, which is a critical strength. However, once transactions are confirmed, they are virtually irreversible. While this feature prevents fraud and double-spending, it also makes correcting errors or reversing transactions challenging, even in cases of fraud or mistakes.

Security Concerns: The irreversible nature of blockchain transactions makes them attractive targets for hackers. Once funds are stolen, recovering them becomes extremely difficult, emphasizing the need for robust security measures, including secure private key management and user education.

Lack of Interoperability:

The "Silo Effect": Blockchain networks often operate as isolated silos with limited compatibility between them. This lack of interoperability hinders the seamless transfer of assets and data across different blockchains, limiting their potential for cross-platform applications and collaborations.

Technical Challenges: Establishing interoperability between diverse blockchain networks requires building bridges or protocols. This process involves achieving consensus among different blockchain communities and standardizing protocols, which can be complex and time-consuming.

While blockchain technology has the potential to revolutionize many industries, it is crucial to be aware of and manage its inherent risks. From security vulnerabilities and regulatory uncertainties to environmental concerns and scalability issues, the path to widespread blockchain adoption comes with significant challenges.

However, forward-thinking initiatives like U2U Network are actively addressing the question, "What are the risks of blockchain technology?" U2U Network’s innovative DAG architecture and focus on enterprise solutions work towards creating a more secure, scalable, and sustainable blockchain ecosystem. By prioritizing sustainability, U2U Network also minimizes the environmental impact of this technology, demonstrating their commitment to building a greener future for blockchain.

.png)