The FMG DePIN Report: The Future of DePIN (2024) provides a comprehensive overview of the DePIN landscape, offering valuable insights for investors, entrepreneurs, and anyone interested in the future of decentralized technology. Discover how DePIN is reshaping industries and creating new economic models. Let’s explore in this article!

Table of Contents

- The inevitability of DePIN

- How are Layer 1/2 compatible with DePIN today?

- DePIN verification middleware - The golden opportunity

- DePIN miners

- DePIN application categories

- Future of DePIN AI

- DePIN sensors - the new AI-driven potential segment

- DePIN wireless & DePIN energy

- Edge AI - the next breakthrough in DePIN’s supply side

- DePIN- a new method for issuing RWA (Real-World Assets)

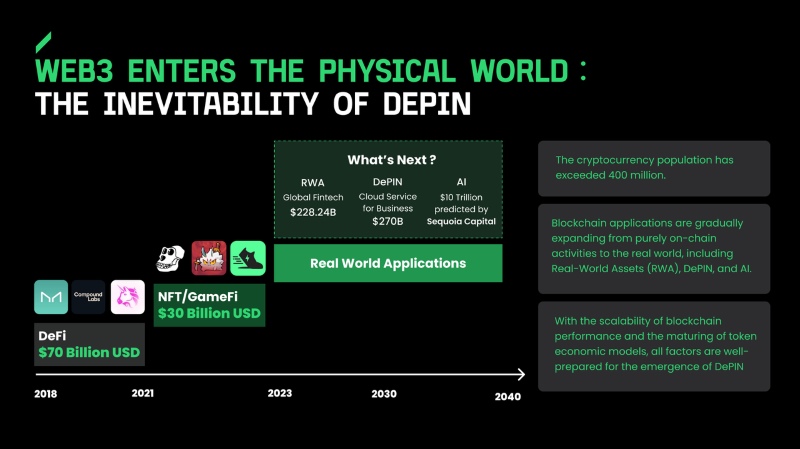

The inevitability of DePIN

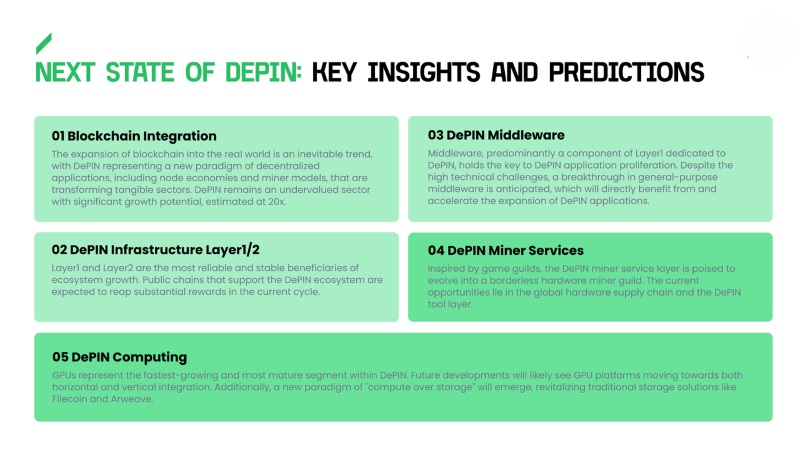

The integration of blockchain technology into real-world applications is an unstoppable trend. DePIN exemplifies this shift through its decentralized applications, node economy, miner model, and transformative impact on the physical world. While Web 2.0 enabled human interaction with the internet via various input devices, Web 3.0, through DePIN, allows physical hardware to connect with the blockchain. According to Messari's projections, the market value of DePIN could reach $3.5 trillion by 2028, indicating a potential growth of 20 to 120 times its current size.

How are Layer 1/2 compatible with DePIN today?

In this cycle, public blockchains that support the DePIN ecosystem stand to gain the most. DePIN is a central component of the Solana OPOS (Possible on Solana Only) concept. Leveraging this advantage, Solana has rebounded from the fallout of FTX, increasing its market value from a low of $3.6 billion to $89.8 billion—a 25% rise.

Besides Solana, leading DePIN projects are choosing general-purpose base chains like Arbitrum and Polygon. Additionally, DePIN-specific chains such as IoTeX and Peaq, along with Layer 1/2 chains incorporating AI concepts like Near and Aptos, may also see significant benefits from the growth of DePIN in the future.

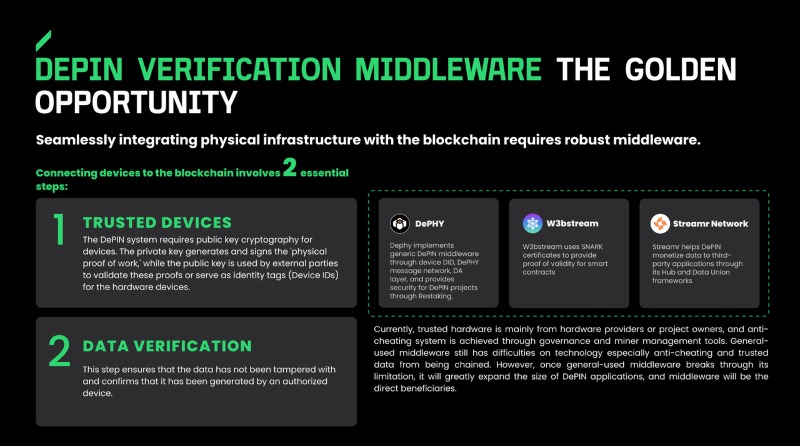

DePIN verification middleware - The golden opportunity

Seamlessly linking physical infrastructure to the blockchain necessitates robust middleware. Currently, trusted hardware is mainly regulated through official authorization, with fraud prevention managed by miner governance and various management tools.

Challenges in developing middleware include:

- High technical complexity: Preventing fraud and reliably uploading data to the blockchain cannot be achieved through technology alone, making the process highly complex.

- Limited market size: The overall DePIN market is currently small, which restricts the market space for middleware.

However, once general middleware overcomes these challenges, it will significantly lower the barrier to entry for DePIN applications, fostering ecological growth. Consequently, middleware will emerge as a direct beneficiary of this development.

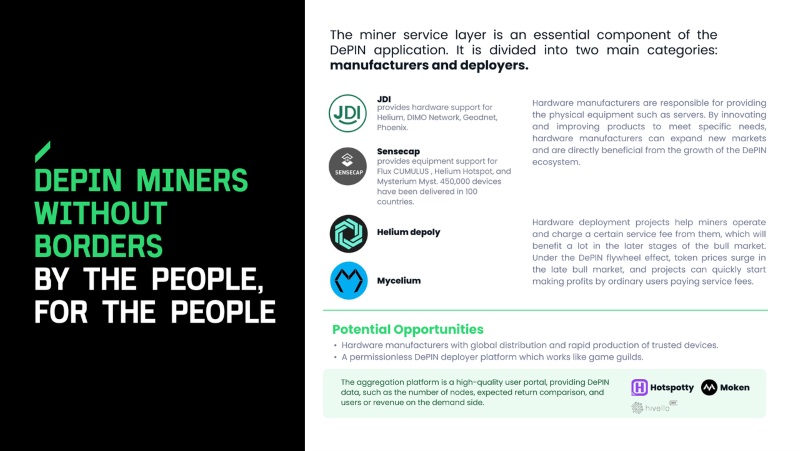

DePIN miners

The foundation of the DePIN ecosystem is the mining service layer, which is essential for DePIN applications. It's comprised of two main categories:

- Hardware Production: Manufacturers create the physical infrastructure (servers, storage, networking) needed for DePIN networks. They drive DePIN growth by innovating to meet specific needs, benefiting directly from ecosystem expansion. Leading hardware manufacturers are key players, contributing through both hardware and financial support.

- Node Operation and Maintenance: These projects assist with node deployment and operation in exchange for service fees. This model thrives in the later stages of a bull market when the DePIN flywheel effect leads to token price increases and rapid node payback. This allows everyday users to quickly profit by paying for these services.

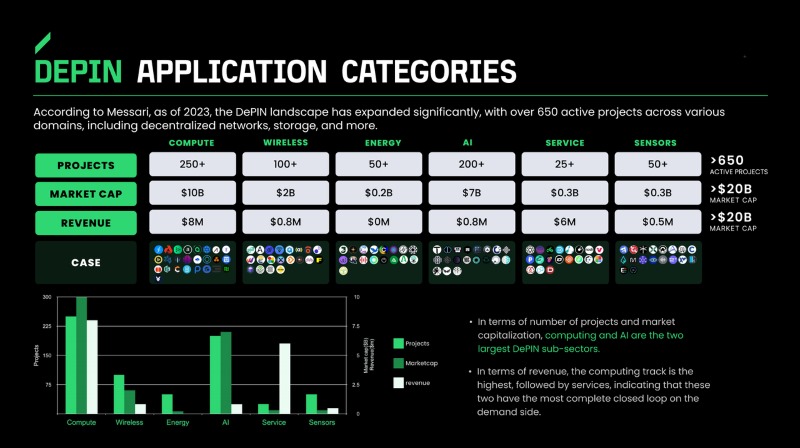

DePIN application categories

According to Messari, by 2023, there will be over 650 DePIN application projects spanning six sectors: computing, AI, wireless networks, sensors, energy, and services.

Compute (computing power + storage) is the largest sector within the Total Addressable Market (TAM), with enterprise cloud services revenue reaching $270 billion in 2023 (Synergy Research). However, GPU platforms often lack their own GPU resources and rely heavily on token incentives, making GPU computing power one of the most volatile sectors in the DePIN ecosystem.

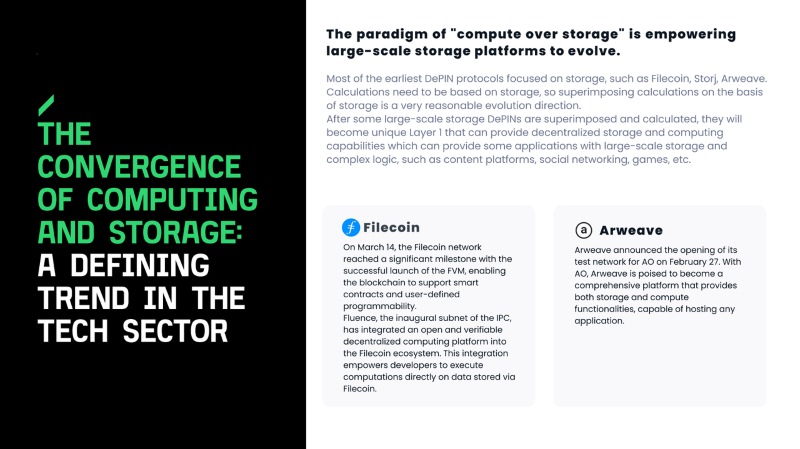

Looking ahead, GPU platforms will pursue horizontal integration and vertical penetration. The concept of "compute-storage integration," which combines storage with computation, will gain traction. Traditional storage solutions like Filecoin and Arweave are expected to experience a resurgence.

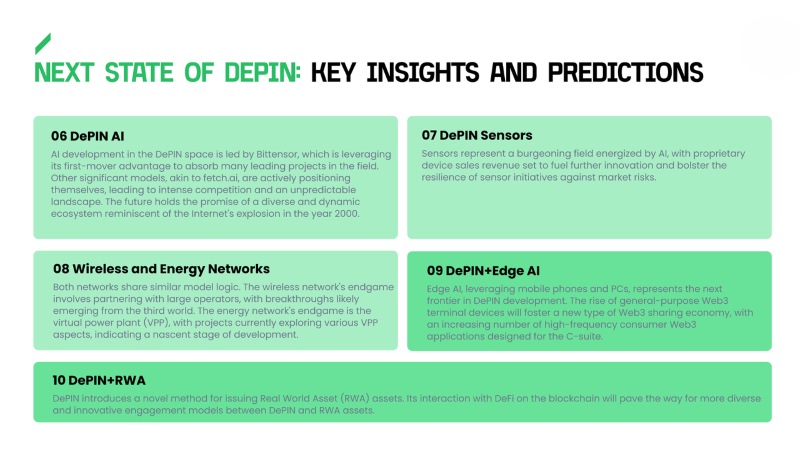

Future of DePIN AI

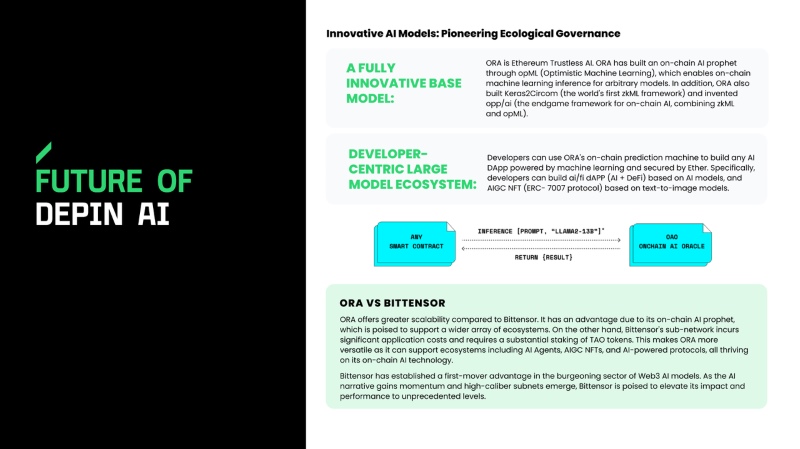

The AI landscape is poised for intense competition, with DePIN AI projects like Bittensor and ORA leading the charge.

Bittensor, a pioneering decentralized machine learning (ML) network, is driving the development and decentralization of AI. As a frontrunner in Web3 AI large models, Bittensor boasts steady growth in model iteration and ecosystem building. Their leadership in large language models has attracted numerous high-profile projects across various sectors.

While Bittensor is groundbreaking, ORA offers a more scalable solution. Bittensor's current subnet application costs are substantial, requiring significant staking of TAO tokens. ORA, however, has successfully implemented on-chain AI oracles, paving the way for a flourishing ecosystem built on this technology.

The future of AI is reminiscent of the 2000 internet boom, promising a fertile ground for diverse AI projects to thrive and innovate.

DePIN sensors - the new AI-driven potential segment

Sensor data is crucial for both training and inferring AI models. Some sensors are even capable of edge computing, which means they can process data right at the source. Meanwhile, steady income from established business areas gives sensor projects the freedom to experiment and take on less risk.

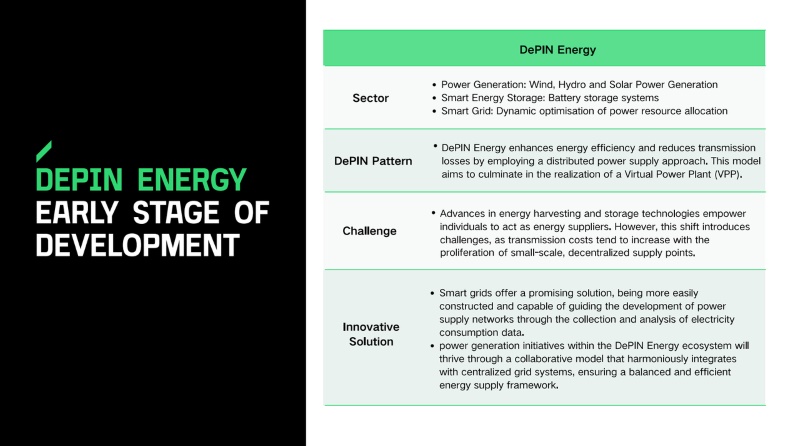

DePIN wireless & DePIN energy

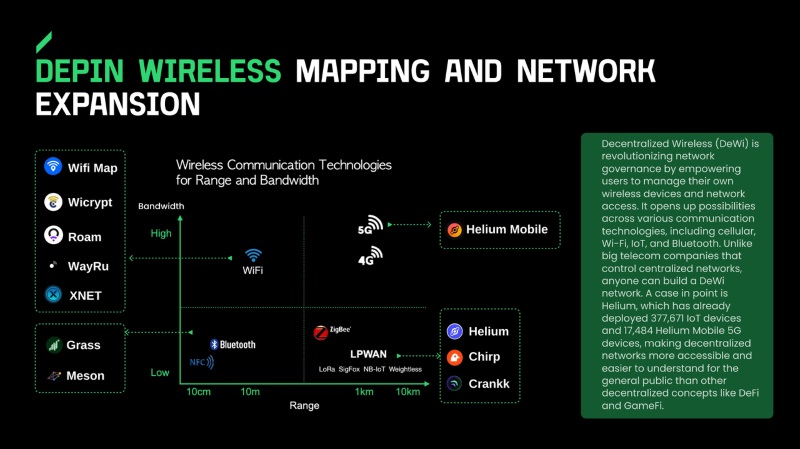

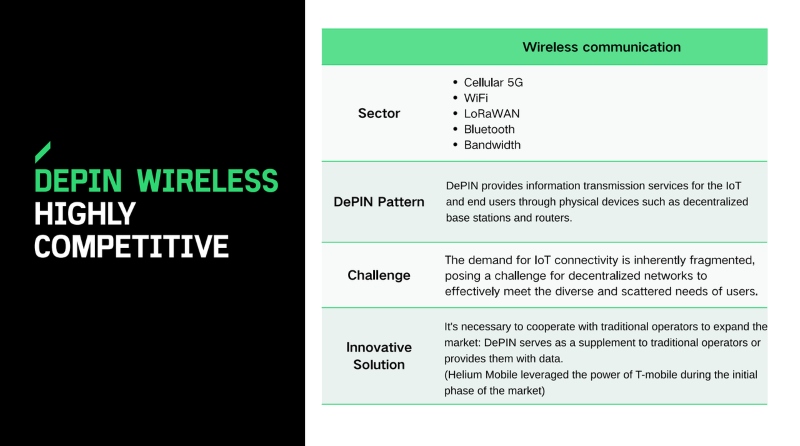

DePIN offers information transmission services for the Internet of Things and end users through a decentralized network of base stations, routers, and other devices. However, the challenge lies in meeting the dispersed demand with this decentralized infrastructure. Partnering with traditional operators is crucial to overcome this obstacle and expand market reach. This can involve using DePIN as a supplemental service or as a data provider for traditional networks.

The key takeaway is that success in wireless communications hinges on collaboration with established operators, as demonstrated by Helium Mobile's reliance on T-Mobile during its initial market entry.

DePIN energy networks are revolutionizing the energy landscape by decentralizing power supply and boosting efficiency, ultimately leading to the establishment of Virtual Power Plants (VPPs). As energy harvesting and storage technology advances, individuals can become energy producers, but transmission costs remain a hurdle. Smart grids, however, offer a solution by using consumption data to guide the construction of efficient power networks. This ease of implementation positions smart grids as the fastest-growing DePIN energy segment.

Like wireless communication networks, the ultimate vision for energy networks is the VPP. This concept, although in its early stages, is being explored through various projects, each aiming to create a future where energy is not only distributed but also intelligently managed.

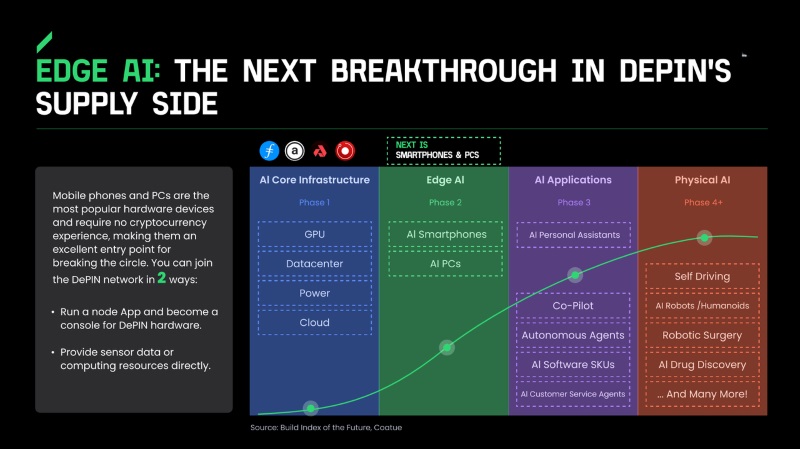

Edge AI - the next breakthrough in DePIN’s supply side

The future of DePIN lies in harnessing the power of Edge AI on smartphones and PCs. This shift opens doors for broader participation in the DePIN network, requiring no prior cryptocurrency knowledge. There are two ways to join the DePIN network:

- Run the node program and become the control end of the DePIN hardware.

- Directly provide sensor data or computing resources.

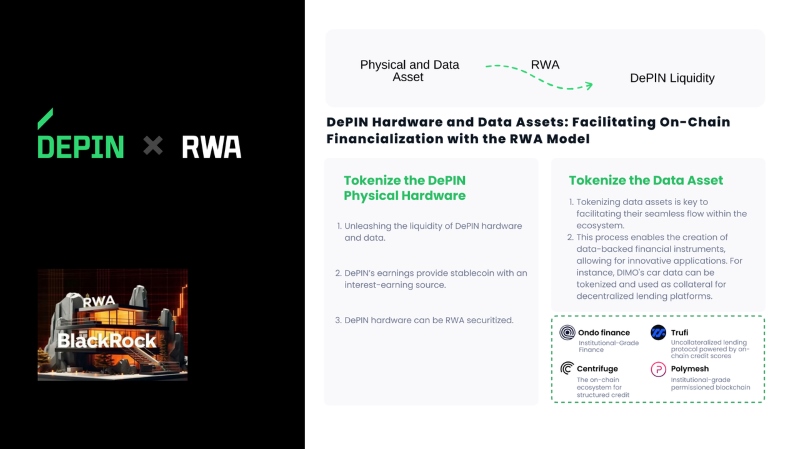

DePIN- a new method for issuing RWA (Real-World Assets)

Tokenization of DePIN physical hardware:

- Liquidity: Hardware assets become tradeable, enabling income separation and mortgage lending.

- Stablecoin backing: DePIN income can serve as a reliable source of interest.

Financial products: Securitization on-chain allows for the creation of Reits-like products (e.g., GPU Index).

Data asset (NFT) tokenization:

- Market flow: Standardized data assets become more easily tradable.

- On-chain finance: Tokenized data supports innovative financial products (e.g., DIMO's car data for loans).

Key insight and prediction:

The information contained in the FMG DePIN Report: The Future of DePIN (2024) provides a comprehensive overview of the DePIN landscape, highlighting its potential to transform industries, create new economic models, and empower individuals through decentralized ownership. Hope this article is useful to you. Don't forget to continue following the U2U Network website to update the latest knowledge and information.

.png)