Similar to the traditional market, there are many ingredient participants in the crypto market, from individuals to organizations. Among them, several objects are considered capable of manipulating the market. The terminology calls that the crypto shark. So what are they? What influence of the crypto shark to the market?

Table of Contents

What is crypto shark?

In the crypto industry, "crypto shark" refers to individuals or organizations that own large amounts of cryptocurrencies. Therefore, every trade of them in the crypto market significantly impacts the market. The term "crypto shark" is quite similar in some respects to "whale crypto." Still, "crypto shark" is fewer than "whale crypto" and has a characteristic tendency to "hunt" other objects in the market.

Ex: CEO Elon Musk of Tesla (US) is typical for crypto shark. In January 2021, he bought 1,5 billion USD Bitcoin to "diversify assets and maximize the return on capital of the car company" and accept payment in BTC when buying Tesla cars. That move caused Bitcoin prices to hit new highs in enthusiastic support of crypto investors continuously.

In the past, "crypto shark" used to be considered a bad factor that had negative effects on the market, such as price manipulation. However, their existence makes the market more vibrant and competitive, simultaneously attracting investors to participate. In fact, some take advantage of shark crypto influence to successfully make a profit.

Moreover, in some meaningful cases, shark crypto tends to collect and buy in bulk to hold when prices go down, helping reduce the market's fall. But usually, most individual investors very difficult to compete with shark crypto and can lose if not against the FOMO and market fluctuations.

Statistical of crypto shark

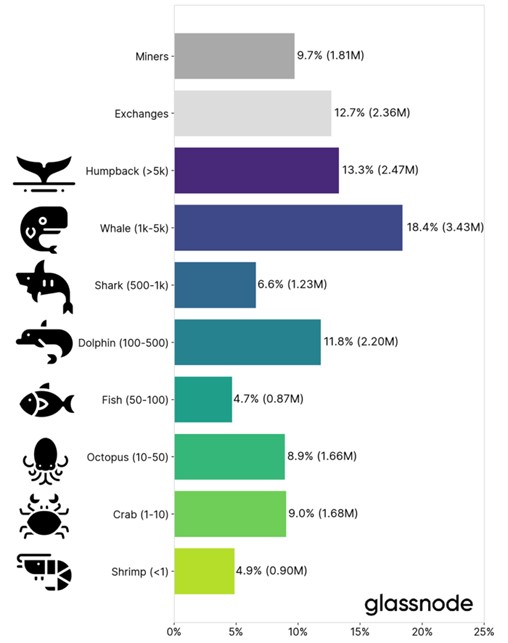

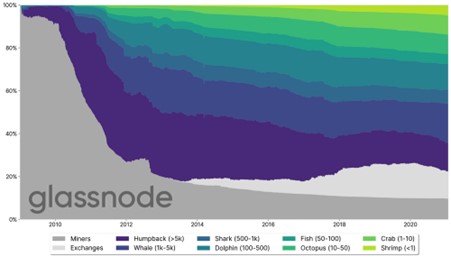

According to the Glassnode report, in 2021, the number of individual and institutional investors owning more than 1,000 BTC has reached 31.7%. About 2% of investors hold 71.2% of Bitcoin. Before that, in 2018, the number of Bitcoin sharks in the total supply of Bitcoin was only 5%.

This report also pointed out that the number of retail investors, whales, and sharks accounts for a high proportion and is increasing. On the other hand, miners are getting lower and lower.

How does crypto shark manipulate the crypto market?

Fake news

Origin from the US former president Donald Trump, fake news is used in a campaign to expose the dirty media tricks of some news agencies. With its strong financial potential, crypto shark can hire unscrupulous media to muddy the waters with vague, inaccurate news to orient the market to benefit them.

Ex: The typical fake news like explode projects or KOL/Celeb invest/PR for scams projects.

Pump and dump

"Pump and dump" is a common trick in the crypto market by individuals or some institutions cooperating to manipulate and blow the market price. It includes two actions:

- Pump: is the bulk buying of a particular coin/token to promote the demand and price of these much higher than the real value for novice investors to follow.

- Dump: After the coin/token price has been "pumped" to a certain level much higher than the initial price, the coin/token will now be sold to make a profit from the price difference.

When all crypto shark has profited enough and exited safely, the coin/token price will stop increasing; the trading volume will decrease. Panic began in the investment community when the price continuously plummeted to the bottom, the latter being lower than the previous. In the end, the victims of sharks were trapped in selling off below market prices or "cutting losses" to salvage what was left.

FOMO

FOMO stands for Fear Of Miss Out and represents a fear of missing out on possible profits if a particular coin/token is not purchased as soon as possible, regardless of its current price.

In the Crypto market, emotions are used to drive transactions more than rationality, so FOMO is a big factor in the decision-making process of cryptocurrency trading. FOMO is a derivative of Pump and Dump. It is often used by crypto shark during the Pump process to inflate the value of a particular coin/token.

Wash trading

This is when buyer and seller continuously and simultaneously buy and sell a particular coin/token in large volume, causing the volume of transactions to increase rapidly. In fact, that increase is not real and is intended to trap technical analysts when looking at money flow into a particular coin/token.

One or a group of sharks cooperates in this act to create a disruptive cash flow for investors. Usually, the signal of this trap and the increase in volume is difficult to discern. Suppose a coin/token suddenly increases in volume, which the price does not change much, but there is no special news. In that case, traders need to ask questions before investing.

Bear Raiding

This act occurs when crypto shark sells in large numbers and bursts through resistance continuously. The constant "broken trend" and resistance penetration make traders - especially traders who adhere to strict discipline - tend to cut losses.

After creating a sell-off wave, the sharks "hunt the goods" at a low price. Usually, Bear Raiding takes place in a short time; the movements in the market are not related to the intrinsic value of the asset it represents. It's all just a shark's price manipulation gimmick.

Spoofing the tape

Spoofing the tape is a gimmick used to increase the depth of the market. Sharks will take many pending buy orders on the exchange without the intention of matching too much volume, increasing the market demand.

When investors rush to buy, the sharks supply them, then silently cancel pending orders. After that, they also quietly withdrew with a considerable profit, leaving those who had swung to the top.

How to find information about crypto shark to alert?

Search orders history

The simplest way to avoid being scammed by sharks in the crypto market is to find information about the number of pending orders to sell or buy on the order books of the platforms and exchanges. If you spot a large volume of pending orders to buy or sell a particular coin/token on the order book, it could be a sign of the arrival of crypto sharks.

@whale_alert

A tool updates the big transactions, reflects on shark/whale activity, and helps investors capture information about ongoing transactions. Therefore, stay current and monitor Whale Alert's information to avoid being trapped by the sharks in the crypto market.

Should to follow crypto shark in the crypto market?

To catch up with the market trend, participants can refer to the information about sharks in the crypto market. However, following the crypto shark is very difficult and a waste of time. Instead, a long-term investment strategy and always observing the market is still better.

If you still want to "swim with sharks," you can find the information about shark wallets to capture the most accurate. Many resources help you with this, such as Twitter account @whale_alert, Coinmarketcap.com, and other websites like Sharkscan.io, whale-alert.io, and whalemap.io. This can help you make sound investment decisions.

How to avoid being scammed by crypto sharks?

Avoiding scams in the crypto space is essential to protect your funds and investments. Crypto sharks are individuals or groups that engage in fraudulent activities to deceive and exploit unsuspecting users. Here are some tips to help you avoid falling victim to crypto scams:

- Do Your Research: Before investing in any cryptocurrency project, conduct thorough research. Investigate the team behind the project, their backgrounds, and their previous experiences. Look for clear use cases, technological innovations, and the project's community support.

- Be Skeptical of Unrealistic Promises: Be cautious of projects or individuals promising unrealistic returns on investments. If an investment opportunity sounds too good to be true, it probably is.

- Verify Official Websites and Communication Channels: Scammers often create fake websites and social media profiles to impersonate legitimate projects. Verify the official website and communication channels of the project before engaging or investing.

- Never Share Your Private Keys: Never share your private keys, recovery phrases, or sensitive information with anyone. Legitimate projects and platforms will never ask for this information.

- Be Cautious of Unsolicited Messages and Emails: Avoid engaging with unsolicited messages, emails, or social media posts offering investment opportunities or claiming you have won a contest or giveaway. Scammers often use such tactics to lure victims.

- Double-Check URLs and Links: Phishing is common in the crypto space. Double-check URLs and ensure you are on the correct website before providing any information or making transactions.

- Use Reputable Exchanges and Wallets: Trade and store your cryptocurrencies on reputable exchanges and wallets. Look for platforms with strong security measures and a history of reliable service.

- Check Token Addresses: When participating in token sales or airdrops, ensure you are using the correct contract address and token symbol. Scammers may create fake tokens to trick users into sending funds to the wrong address.

- Stay Informed: Stay informed about the latest scams and common fraud tactics in the crypto space. Being aware of current scams can help you recognize and avoid them.

- Trust Your Instincts: If something feels suspicious or too good to be true, trust your instincts and refrain from engaging further.

- Seek Professional Advice: If you are unsure about an investment opportunity or need guidance, consider seeking advice from a trusted financial advisor or expert in the crypto space.

Remember that the cryptocurrency industry is still relatively new and can be risky. Being vigilant, doing your due diligence, and exercising caution will go a long way in protecting yourself from potential scams and fraudulent schemes. Be proactive in safeguarding your funds and personal information to have a safer and more rewarding experience in the crypto space.

Above is all information about crypto shark in the market. We hope the article has provided you with the necessary information so that you can invest wisely. Follow Unicorn Ultra's media channels and blog to stay updated with blockchain knowledge, the cryptocurrency market, and investment experiences. Follow https://uniultra.xyz/ to update more interesting knowledge about blockchain.